The One Big Beautiful Bill Act, signed into law on July 4, 2025, brought several changes taking immediate effect this year. With that, you may have also been expecting an instant bigger take-home pay. But no, your paycheck’s not going to increase soon. Not yet.

The IRS recently confirmed that they’re only changing federal income tax withholding tables in the next tax season. The new tax benefits will not be reflected until you file your 2025 tax return in early 2026.

This means that instead of seeing an immediate increase in your paycheck, you should expect to receive the benefits as a larger tax refund or a reduced tax bill when you file next year.

Why Did the IRS Delay the Implementation?

It can be disappointing for many taxpayers, but the IRS’s decision to postpone implementing these benefits until the 2026 tax season is well-founded.

Ensuring System Stability

If the IRS had updated withholding tables immediately, payroll providers and employers would have had to rush to reprogram their systems and update employee withholding forms, which could have led to widespread errors, incorrect withholdings, and massive confusion for both employers and employees.

Preventing Inconsistent Paychecks

Without a unified update, some employers might have adjusted withholding while others did not, creating inconsistent paychecks across the country. The IRS’s decision ensures that all employers continue using the same, stable withholding calculations.

Your Paycheck: It’s Not Lost Money, Just a Delay

The increase in your take-home pay is not lost; it is simply being deferred. Your paycheck increase is just being withheld at the older, pre-tax law rates. The IRS is yet to release specific guidance in the coming months on how to claim these new benefits.

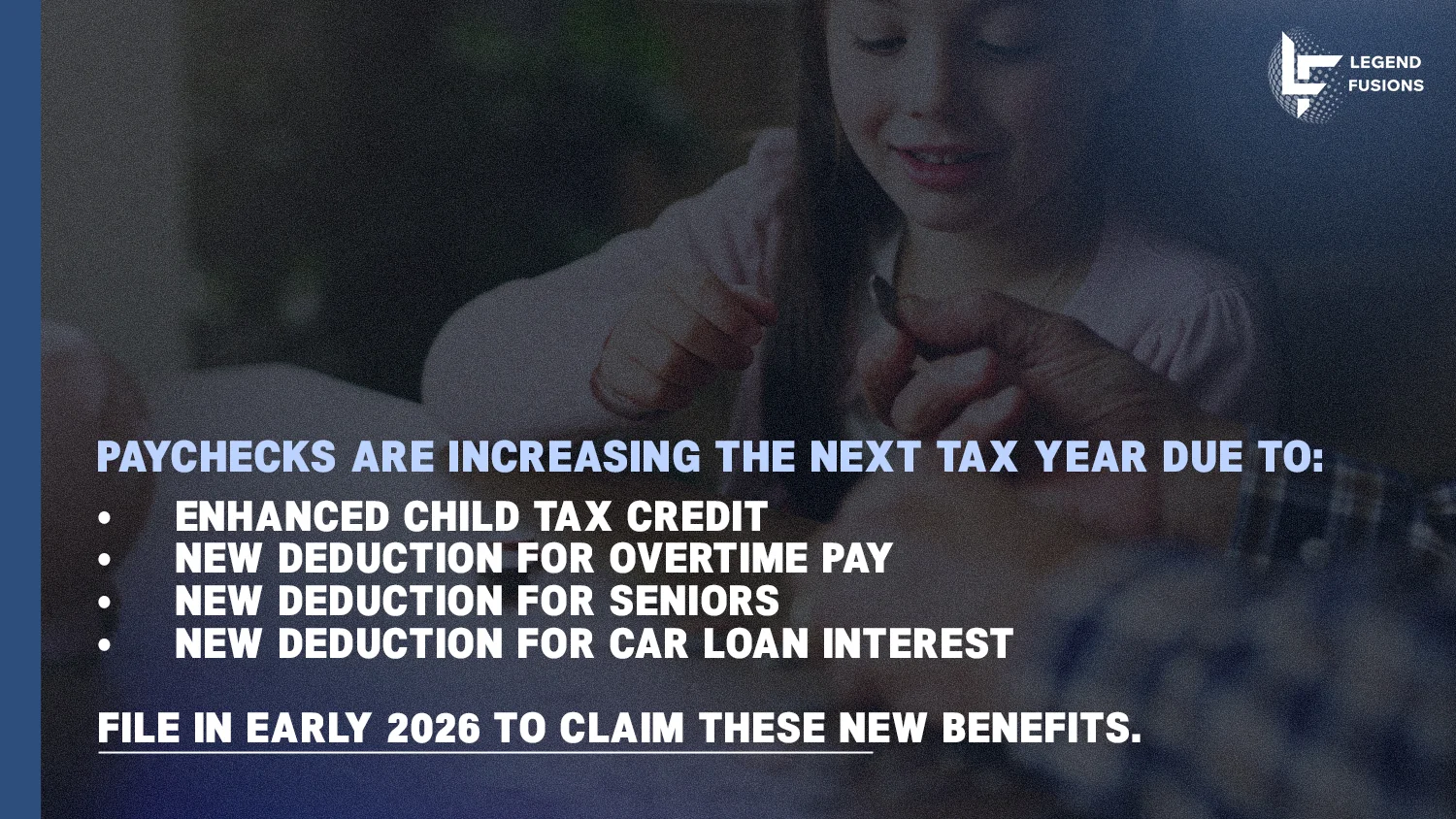

What Tax Benefits Will You Receive When You File in 2026?

These are the benefits you can expect to claim when you file your taxes early next year:

Enhanced Child Tax Credit

- Increased to $2,200 from $2,000 per qualifying child.

- A maximum of $1,700 refundable portion per child for eligible families.

New Deduction for Overtime Pay

- Up to $12,500 deduction per person for qualifying overtime pay that exceeds regular rate. If you’re a couple, that could be up to $25,000 deduction in total.

New Deduction for Seniors

- Additional deduction of up to $6,000 per person aged 65 and older.

- An extra deduction on top of the existing senior standard deduction and is available to both itemizers and non-itemizers.

New Deduction for Car Loan Interest

- If you purchased a new vehicle after December 31, 2024, and secured a loan for it, deduction may be up to $10,000 in interest paid on that loan.

What You Should Do Now to Prepare for Next Year

The IRS is actually giving you a full year to prepare for these changes. Here’s what you should be doing right now to take full advantage of the new tax benefits:

- Start tracking your information. For example, if you plan to deduct overtime, keep detailed records of your hours. If you are a senior, keep all the necessary documents so you can claim the new deduction.

- With a bigger tax refund next year, you can use that to pay down debt, save for a big purchase, or add to your retirement fund.

- Review your withholding, especially if you tend to receive larger refunds already. Next year, you may get even larger refunds. However, you may want to review your withholding to ensure you’re not overpaying.

- The best you can do is consult a professional. A lot of these new rules can be complex. It’s better to get full understanding of how they’ll affect you and ensure you have all documents in place to maximize your refund next year.

Need More Clarity? Get Expert Advice Today

It’s easier to get confused about what’s changing and not. But don’t worry, changes to withholding tables are only taking effect next year. What you should be doing now is prepare to get maximized tax refunds.

If you have lingering questions about your benefits or want to ensure you’re prepared for the 2026 tax filing, our experts are here to help. The IRS will soon announce how you can claim the new benefits. Stay updated with current tax events here at Legend Fusions.

Hira Asif

Hira Asif, Client Manager (US) at Legend Fusions, brings over 11 years of tax expertise, including 8 years with Ernst & Young. Her work focuses on tax advisory, compliance, and planning for individuals, partnerships, and private equity funds. With a deep knowledge of federal, state, and local tax regulations, Hira is skilled in identifying tax planning opportunities and reviewing corporate and partnership tax returns to optimize compliance and reduce exposures.