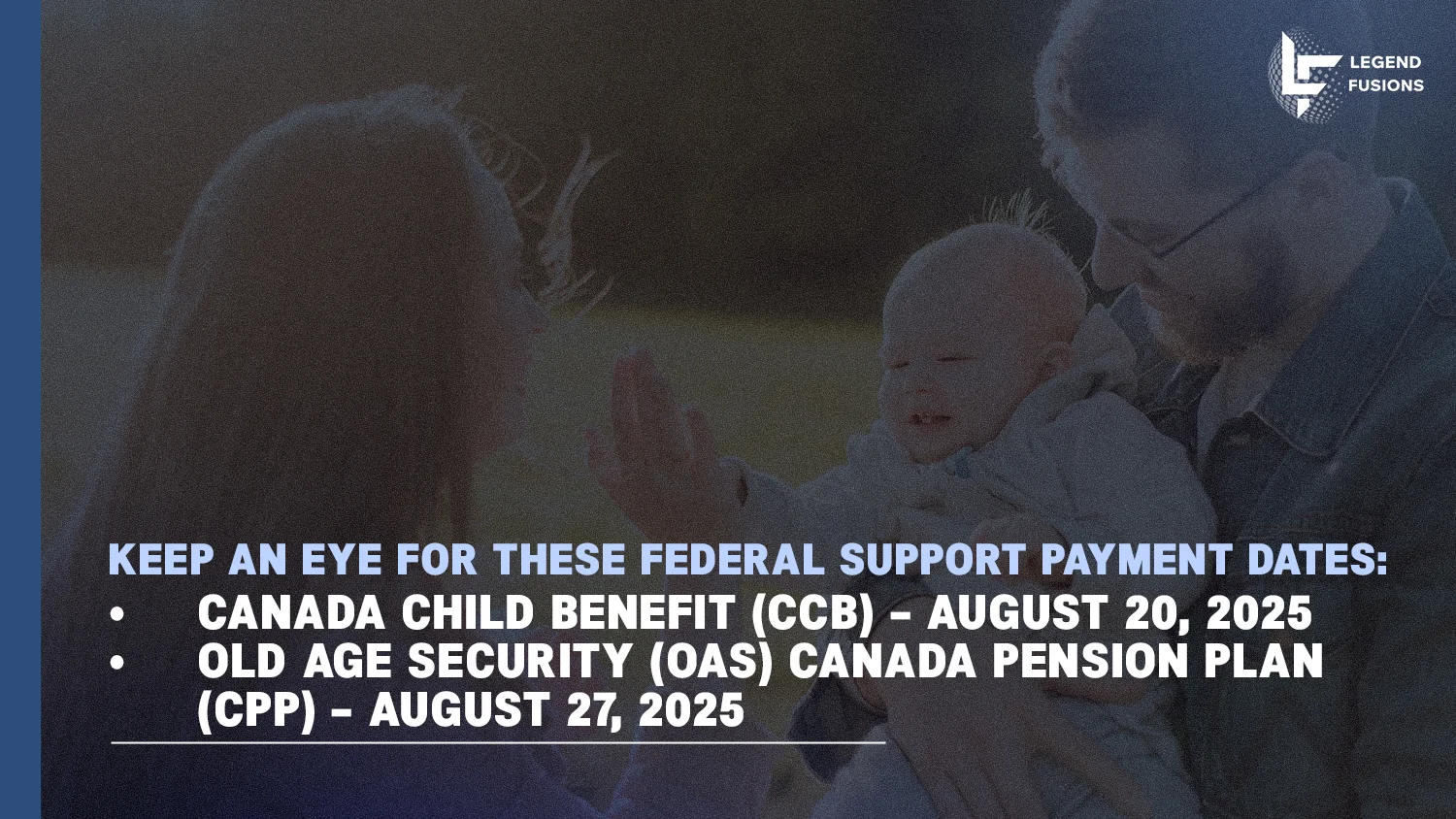

Three federal financial supports are coming your way this month, and it couldn’t have been more timely, as the school year reopens this early September. Millions of Canadian families can expect:

- Canada Child Benefit (CCB) payment on August 20, 2025

- Old Age Security (OAS) and Canada Pension Plan (CPP) payments on August 27, 2025

The CCB arrives just in time for your last-minute back-to-school shopping, and the OAS/CPP payments are again about to provide crucial end-of-the-month relief for seniors.

Back-to-School Budget Boost: Canada Child Benefit

The CCB is a tax-free monthly payment for eligible Canadian families raising children under 18. The payment coming next week may be spent on school supplies, new clothes, educational technology, or extracurricular fees.

Sending a child back to school is incredibly costly, but the CCB is just in time to offset this financial strain, buffering the also-rising household expenses.

Vital End-of-the-Month Relief for Seniors: OAS/CPP

Before August ends, Canadian seniors on fixed incomes and tight budgets will expect OAS/CPP payments. This is yet another tax-free support that helps seniors who are hit hardest by the rising cost of living, from groceries to utilities and prescription costs.

What You Need to Do Now

Prevent unexpected delays by taking the time to ensure your information is updated and your accounts have no issues:

- Confirm Your Payment Date. Keep an eye on your bank account on August 20 for the CCB and on August 27 for OAS/CPP.

- Check Your CRA My Account. The Canadian government no longer sends paper mails, so you can now only receive notices through your official account.

- Verify Your Direct Deposit. Make sure your banking information is up-to-date and correct.

What If It Doesn’t Arrive?

Jeffrey Ross

Jeffrey Ross is an experienced tax accountant focused on US-Canada cross-border taxation, with over three years in the industry, including a key role as client manager at a Canadian tax firm. He provides expertise in corporate and personal tax planning, specializing in non-resident tax, capital gains, CRA and IRS compliance, and retirement planning. Known for his personalized approach, Jeffrey is dedicated to guiding clients with clear, practical advice tailored to complex tax scenarios, aligned with the evolving tax laws.