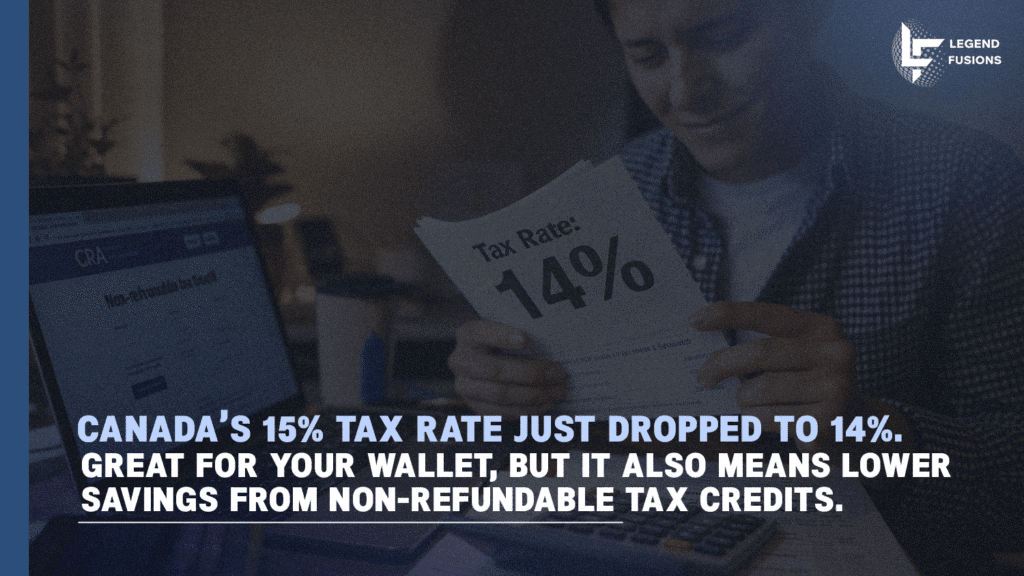

Good news, Canada! As of July 1 the highly anticipated federal tax cut has taken effect. The lowest federal personal income tax rate has dropped from 15% to 14%, putting a little extra back in your pocket.

But here’s the twist: this lower rate also changes how some of your tax credits work, especially non-refundable ones. So while you’re saving on tax overall, the value of certain credits is slightly shifting.

Let’s break down what that means for your return.

How Non-Refundable Credits are Calculated

Federal non-refundable tax credits, such as the Basic Personal Amount (BPA), the Canada Caregiver Credit, and the Disability Tax Credit, help lower your federal tax bill. They reduce the amount of tax you owe, but only to a minimum of zero. Unlike refundable credits, they don’t result in a cash refund if your tax owing is already zero.

These credits are calculated by multiplying a fixed base amount (for example, the BPA) by the lowest federal personal income tax rate.

Now that the rate has dropped from 15% to 14% as of July 1:

- You’ll see a slightly smaller tax saving from each eligible dollar of non-refundable tax credits.

- For instance, claiming the full BPA now gives you a credit calculated at 14% of the amount instead of 15%. That’s a marginal reduction in tax savings from these credits, even though your overall tax burden is lower.

Important Note: While the individual value of these credits is slightly reduced, the overall intent of the tax cut is to provide net savings to Canadians. No family is expected to see an increase in their federal taxes payable due to this change. However, for those who rely heavily on these credits, the magnitude of their tax relief might not be as high as if the credit value remained at 15%.

Why Earlier Tax Planning Matters Now More Than Ever

Knowing about these shifts as they take effect in July gives you an opportunity to:

- Review your financial situation: Consider how changes to both tax rates and credit values might impact your overall tax liability and financial plan for the year.

- Optimize deductions: Ensure you’re maximizing all eligible deductions, which reduce your taxable income before credits are applied.

- Plan for the future: These changes underscore the value of proactive tax strategies, so that you’re always positioned to benefit from tax efficiencies and avoid surprises.

At Legend Fusions, we believe in empowering Canadians with clear, timely information to navigate their taxes effectively. Contact us for personalized tax planning advice.

Jeffrey Ross

Jeffrey Ross is an experienced tax accountant focused on US-Canada cross-border taxation, with over three years in the industry, including a key role as client manager at a Canadian tax firm. He provides expertise in corporate and personal tax planning, specializing in non-resident tax, capital gains, CRA and IRS compliance, and retirement planning. Known for his personalized approach, Jeffrey is dedicated to guiding clients with clear, practical advice tailored to complex tax scenarios, aligned with the evolving tax laws.