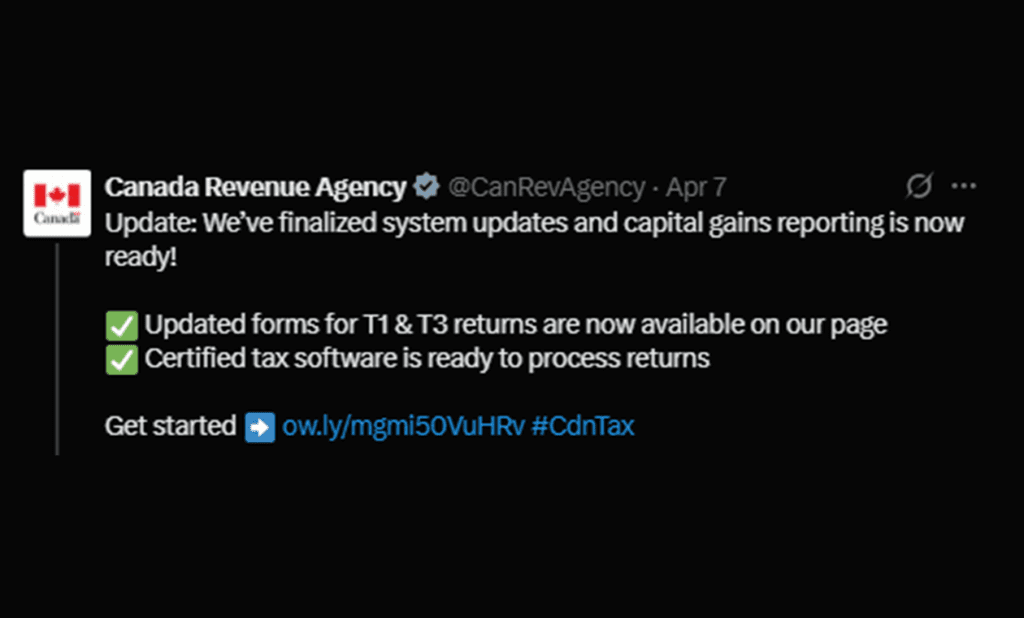

Last month, CRA announced to hold off filing returns if you have 2024 capital gains to report, needing more time to update systems for the capital gains inclusion rate reversal. To compensate, the late filing penalty and interest is waived, giving you more time to file.

You can now file your T1 return, or T2 if you are a trust filer, without worrying about the regular tax deadline this April 30. No penalty applies if you file on or before June 2, 2025. For trust filers, your penalty-free deadline is moved to May 1.

For regular tax filers (without 2024 capital gains to report), deadline is as usual—by the end of this month. Note that you will still have to pay your tax arrears by April 30.

When is the New Capital Gains Inclusion Rate Happening?

For this tax year, the capital gains inclusion rate remains at 50% for gains within $250,000. The additional inclusion rate of 66.67%, which applies to taxable gains over $250,000, may be officially implemented next year (tentative).

Check out how to calculate your taxable gains once the new inclusion rates take effect.

For this filing season, be sure to take advantage of CRA’s My Account to access your tax and benefits in one place.

If you are doing taxes for the first time, Legend Fusions can help. Stay updated – contact us today!

Jeffrey Ross

Jeffrey Ross is an experienced tax accountant focused on US-Canada cross-border taxation, with over three years in the industry, including a key role as client manager at a Canadian tax firm. He provides expertise in corporate and personal tax planning, specializing in non-resident tax, capital gains, CRA and IRS compliance, and retirement planning. Known for his personalized approach, Jeffrey is dedicated to guiding clients with clear, practical advice tailored to complex tax scenarios, aligned with the evolving tax laws.